Gomercury.com Pre-Approved Application

Gomercury.com Pre Approved Application Are you tired of the endless paperwork and waiting times of opening a checking account? Look no further than Gomercury, the innovative insurance company that offers pre-approved applications in less than 15 minutes.

With over 40 million sites accepting their cards, Gomercury has become a popular option for not only US residents but also non-US residents. In addition to their easy account setup process, Gomercury provides a variety of benefits, such as a regular debit card and cash flow analytics, to help you manage your finances effectively.

Whether you’re a busy professional or a student on the go, Gomercury offers a hassle-free experience that will meet your banking needs.

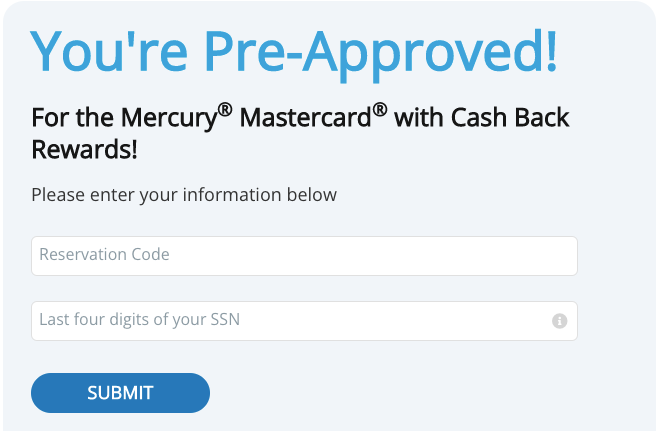

How do I get the reservation code for www.gomercury.com?

If you don’t have your offer letter on hand, don’t worry generating an activation code on the website is simple and quick.

With a few clicks, you’ll be one step closer to finding the perfect flights, hotels, and more for your next adventure. So why wait? Get your activation code today and start exploring all the amazing travel options available to you through www.gomercury.com.

To activate the reservation code and apply, please provide your last name, zip code, and the last four digits of your SSN. Simply enter the required information in the designated fields and click on the “Apply Today” button.

How Do I Pay With My Mercury Card?

Enter your birth month, birth year, and credit card number or your social security number, both options are available for you to choose from.

Additionally, if you prefer to make payments through your mobile devices, the Mercury Card Android and iOS Applications are also at your disposal. So, rest assured that you don’t have to go through any hassle while making your Mercury Card Payment.

How can I apply for a Mastercard from Mercury?

When it comes to applying for a Mercury Mastercard, the process is a little different than other credit cards. You first need to receive an invitation from someone that will include a reference code.

Once you have that code in your possession, you can begin the application process. The first step is to make sure you spot your reservation code in the invitation mail and keep it with you. Then, add and activate your reservation code to move forward with filling out the application form.

This includes basic identifying information, financial details, and other miscellaneous information. Once you submit the form, you’ll need to upload documents about your financial status. From there, you’ll just have to wait 4-5 days to hear if your card is approved.

Overall, while there are a few extra steps, the Mercury Mastercard might just be worth the effort.

What are the requirements for applications?

when you’re required to submit specific documents, like an Employer Identification Number (EIN), it can add even more stress. But the fear of not obtaining an EIN is actually quite simple.

There are a few different forms you can use, like Form 147c or Form CP575, and you’ll also need to have a filled-out SS-4 form. In addition to these documents, you’ll need a government ID issued by the United States and an LLC document with its address.

Once you have all these requirements, you’ll be on your way to launching your business with confidence.

Gomercury.com Pre-approved application Apply online, Reservation Code April 28, 2023

| Annual Fees | $0 |

| Credit Limit | Depends on creditworthiness |

| Purchase APR | 27.24% – 29.24% (V) |

| Cash Advance APR | 27.24% – 29.24% (V) |

| Cash advance fee | 5% or (min $10) |

| Late payment fee | $40 |

| Grace Period | 23 days |

| Minimum Required Credit Score | 550 to 640+ |

| Security Deposit | Nil |

Best Online Bank? | Mercury Bank Account Honest Review

This unsecured card is unique in that it not only gives you access to FICO scores but also boasts high APRs. Although it’s not solely owned by Barclays, the Credit Shop has taken over many of its customers with average or bad credit scores.

Don’t let a yearly fee hold you back from using a credit card apply for the Credit Shop card today.

Benefits of a Pre-Approved Mercury Mastercard

The Go Mercury Mastercard offers a number of advantages that are to its advantage.

- Your FICO (Fair, Isaac, and Company) score is completely accessible to you.

- All three central bureaus receive the report.

- You are not responsible for any fraudulent activity if your card is stolen or lost.

- The Mastercard does not require a yearly fee to be held.

Call the Mercury credit card customer support line at this number

Mercury Credit Card offers a dedicated phone number for all your payment and assistance needs: 1-866-686-2158. Whether you’re having trouble with your account, need to make a payment, or simply have a question, their friendly representatives are eager to help.

And if you’re running into trouble with their website, there’s no need to worry they’ve got a separate line just for that, at 1-833-766-4844. So don’t hesitate to reach out Mercury Credit Card is here to make your credit experience as smooth and stress-free as possible.

Mercury Mastercard Credit Card Payment Address

Mercury Card Services

P.O. Box 70168

Philadelphia, PA 19176-0168

Use AutoPay to make a payment

Do you ever find yourself forgetting to pay bills on time, resulting in pesky late fees and charges? Well, the solution is easier than you might think. By utilizing the “AutoPay” method, you can avoid these frustrating fees altogether.

All you have to do is head to the official website, log in to your account, and click to enroll in “AutoPay” on your account summary. This method ensures that your minimum amount due, statement balance, and fixed amount will be automatically paid without any delays.

Plus, if you ever need to cancel, you have up to three days before your due date to do so. So don’t stress about missing payments anymore let “AutoPay” take care of it for you.

FAQs

It is legitimate and enables those with fair credit to responsibly utilize the card to raise their score.

What Is The Price Of A Mercury Credit Card?

One fee that may catch you by surprise is the application fee, which can cost anywhere from $35 to $55. This fee is used to cover processing costs and ensure that only serious applicants are considered.

While some claim that the card targets consumers with fair credit on the FICO score scale (580 to 669), the minimum score required to be eligible for the card is actually 550.

Who Can Get a Mercury Credit Card?

One of those requirements, for US citizens, is the provision of the last four digits of your Social Security number. However, if you are not a US citizen, there are different steps that must be taken to prove your non-US citizenship status. Regardless of citizenship status, another requirement for credit card applications is being at least 18 years old.

Well, you are in luck because the process is simple and hassle-free. Just navigate to the More Options button and select Cancel Card. Once you confirm your choice, your card will be canceled.

It is important to note that once you confirm, the action cannot be undone. So make sure you are certain about canceling your card.

With this easy and straightforward process, you can easily cancel your card without any stress or complications.

Are you in need of some extra cash but don’t know where to turn? With just a few simple steps, you can easily avail a cash advance to help cover those unexpected expenses.

Just give Mercury Customer Service a call at (866) -686 -2158 to request a PIN, if you don’t already have one.

Then, head to your nearest ATM and insert your card, selecting the “Cash Advance” option on the screen. It’s that easy! Don’t let financial stress weigh you down take advantage of the convenience and flexibility of a Mercury Credit Card cash advance today.

Conclusion

With its numerous benefits, this card has quickly become a popular choice amongst global consumers. However, it’s essential to weigh up the pros and cons before making a final decision.

By reading this article, you’ll not only gain insight into the Go Mercury Mastercard but also discover whether it’s the right choice for your financial needs. So why not take the plunge and give this credit card a try? It may just be the solution you’ve been searching for.